The Construction Marketing Association (CMA) undertook a national survey on construction service company RFQ/RFP practices. The objective of this specialized study was to identify best practices and benchmarks for use by construction firms of all types and sizes, as this type of study is rarely available in the public domain. The following questions were asked:

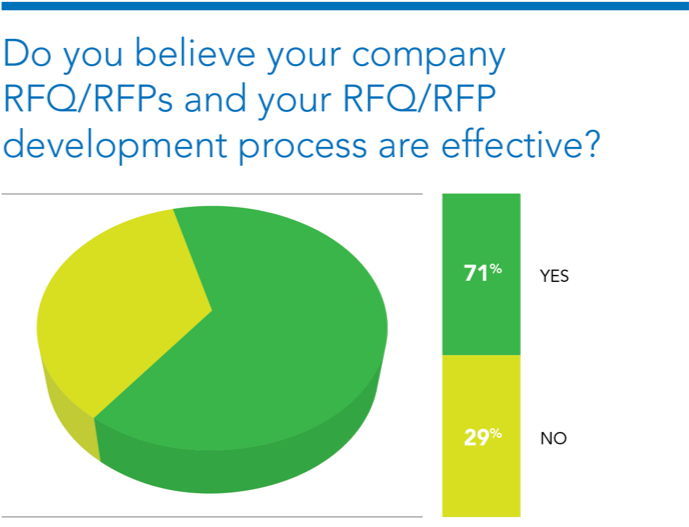

- Is your RFQ/RFP process effective?

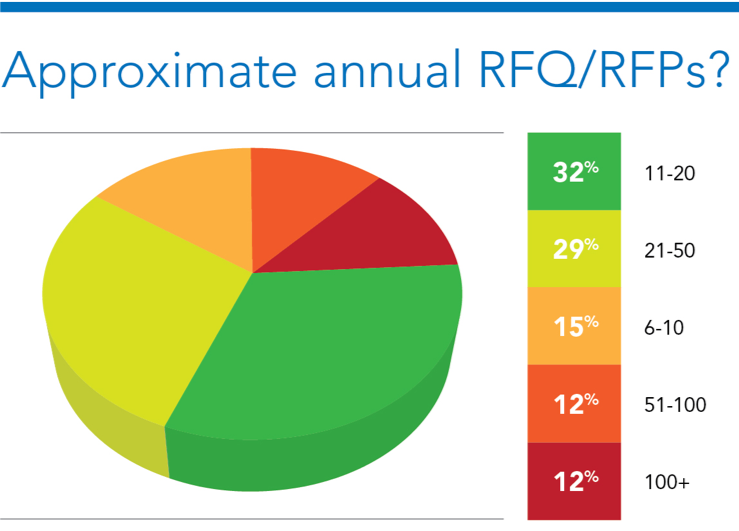

- What quantity of RFQs/RFPs do you receive per year?

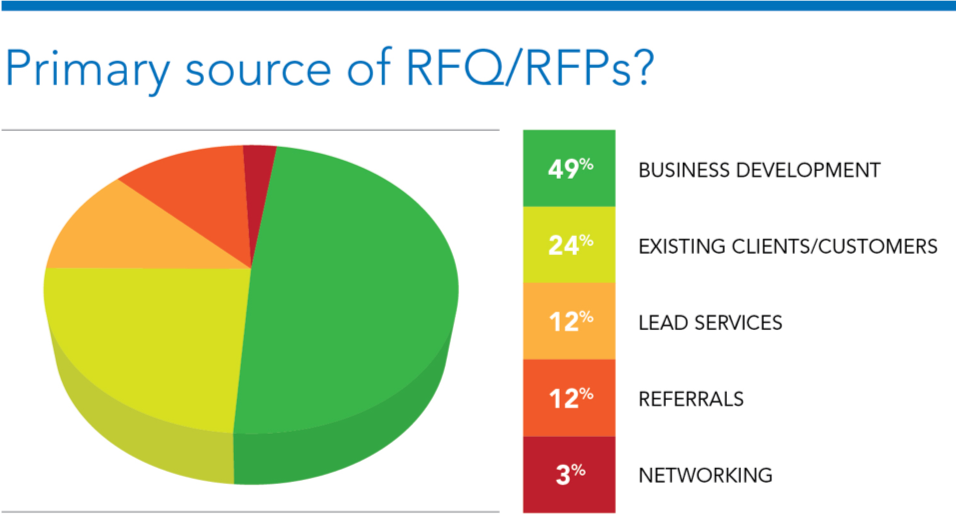

- What is the primary source of RFQs/RFPs?

- What is your company’s approximate win rate?

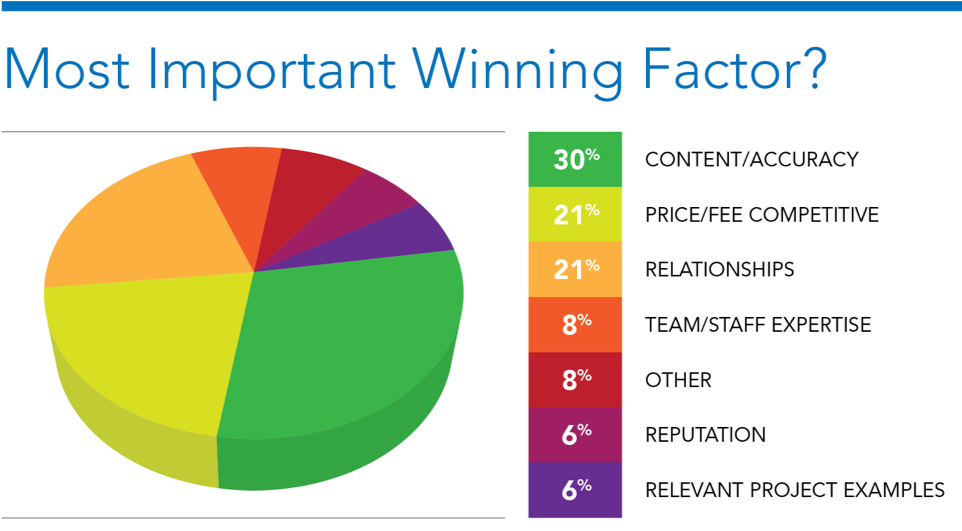

- What is the most important RFQ/RFP winning factor?

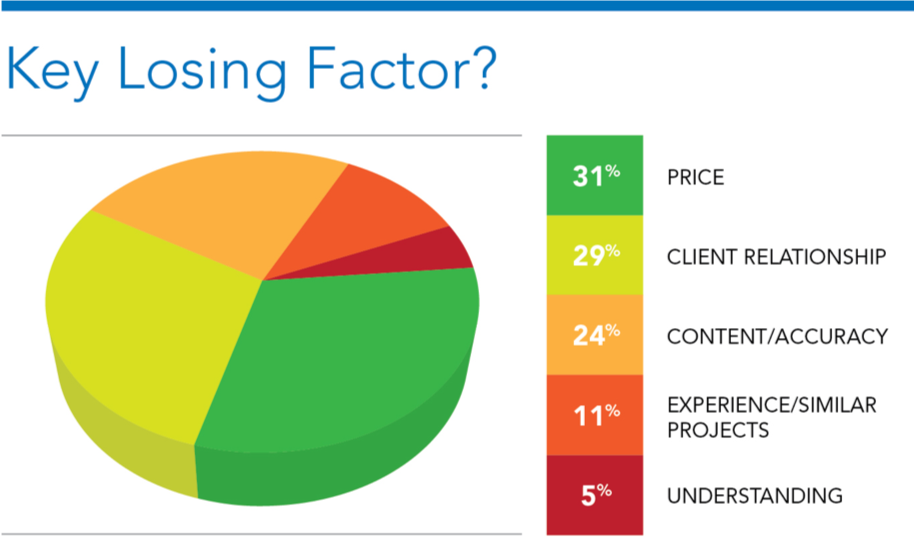

- What is the key losing RFQ/RFP factor?

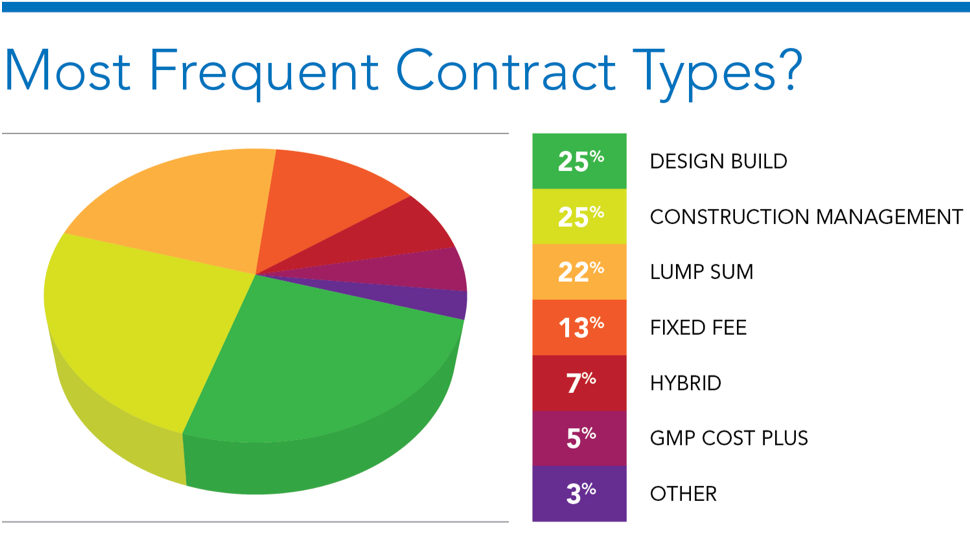

- What is the most frequent contract types?

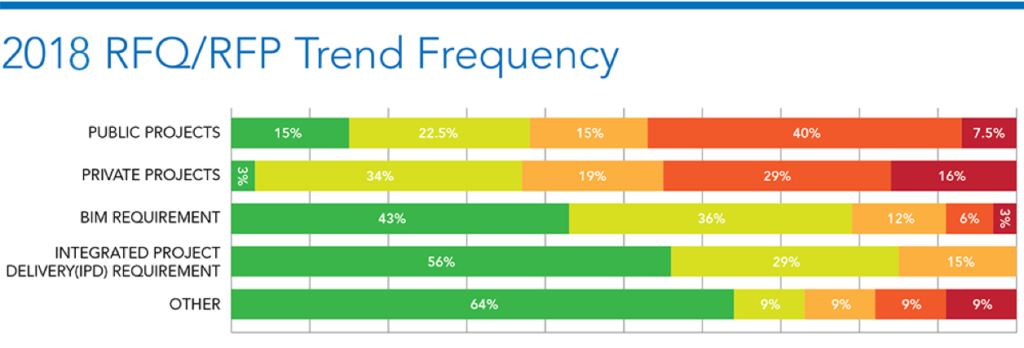

- What are project type trends?

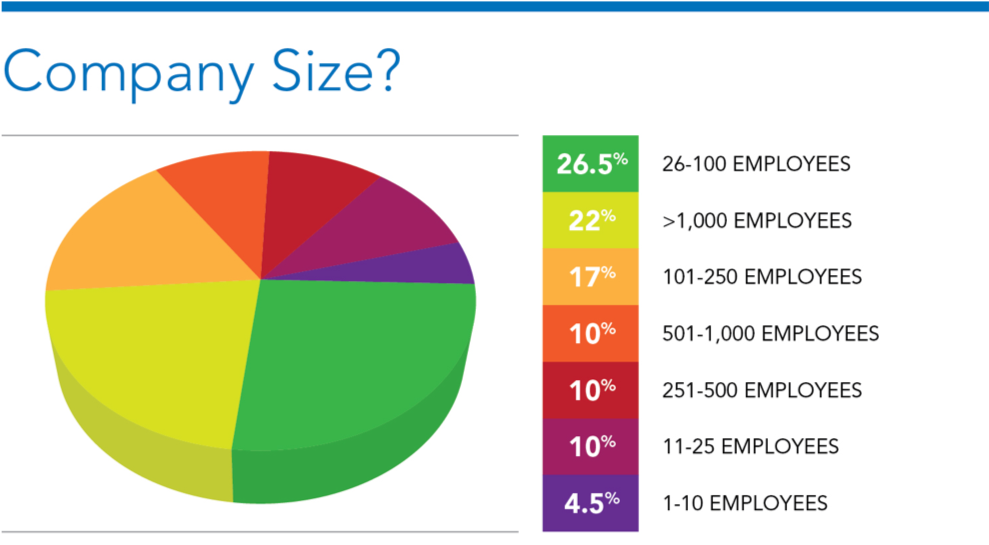

- Company classifications: Size / Geo / Type

71% of respondents indicated that their RFQ/RFPs and their RFQ/RFP development processes are effective.

The majority of respondents indicated that they typically complete 11-20 (32%) or 21-50 (29%) RFQ/RFPs per year.

Business development (49%) is the top source of RFQ/RFPs. Networking is the least frequent source of RFQ/RFPs with only 3%.

The top three factors in winning an RFQ/RFP submission are content/accuracy (30%), price/fee competitive (21%), and relationships (21%).

The top three factors in losing an RFQ/RFP submission are price (31%), relationships (29%), and content/accuracy (24%).

The top three most common types of construction contracts over the past year included design build (25%), construction management (25%) and lump sum (22%).

RFQ/RFP trends in 2018 were ranked as the following:

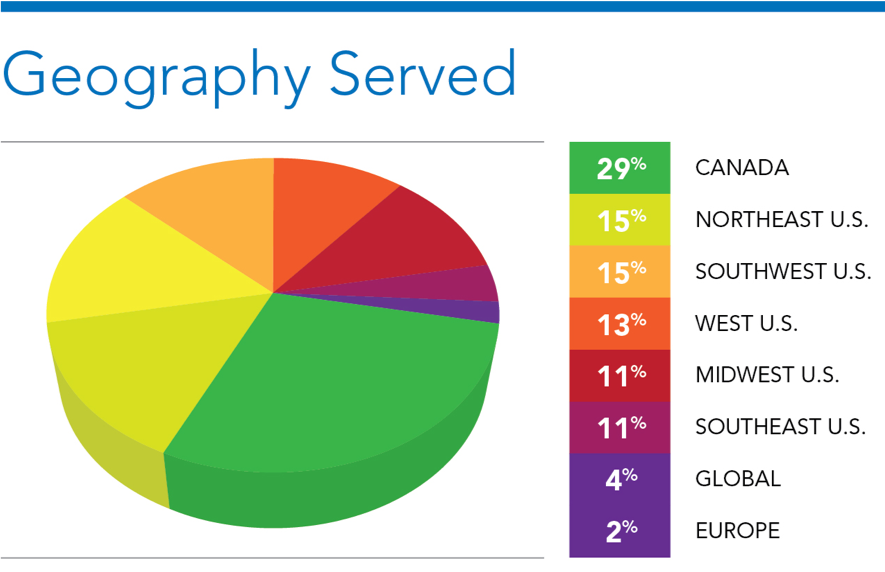

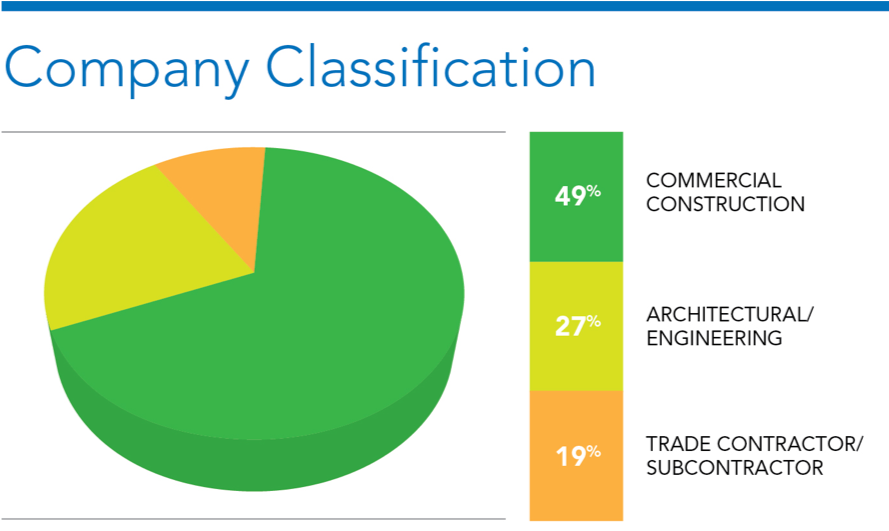

Please see charts below for respondent demographics:

To view complete RFQ/RFP Best Practices Presentation, click here.

Check out our upcoming events here.